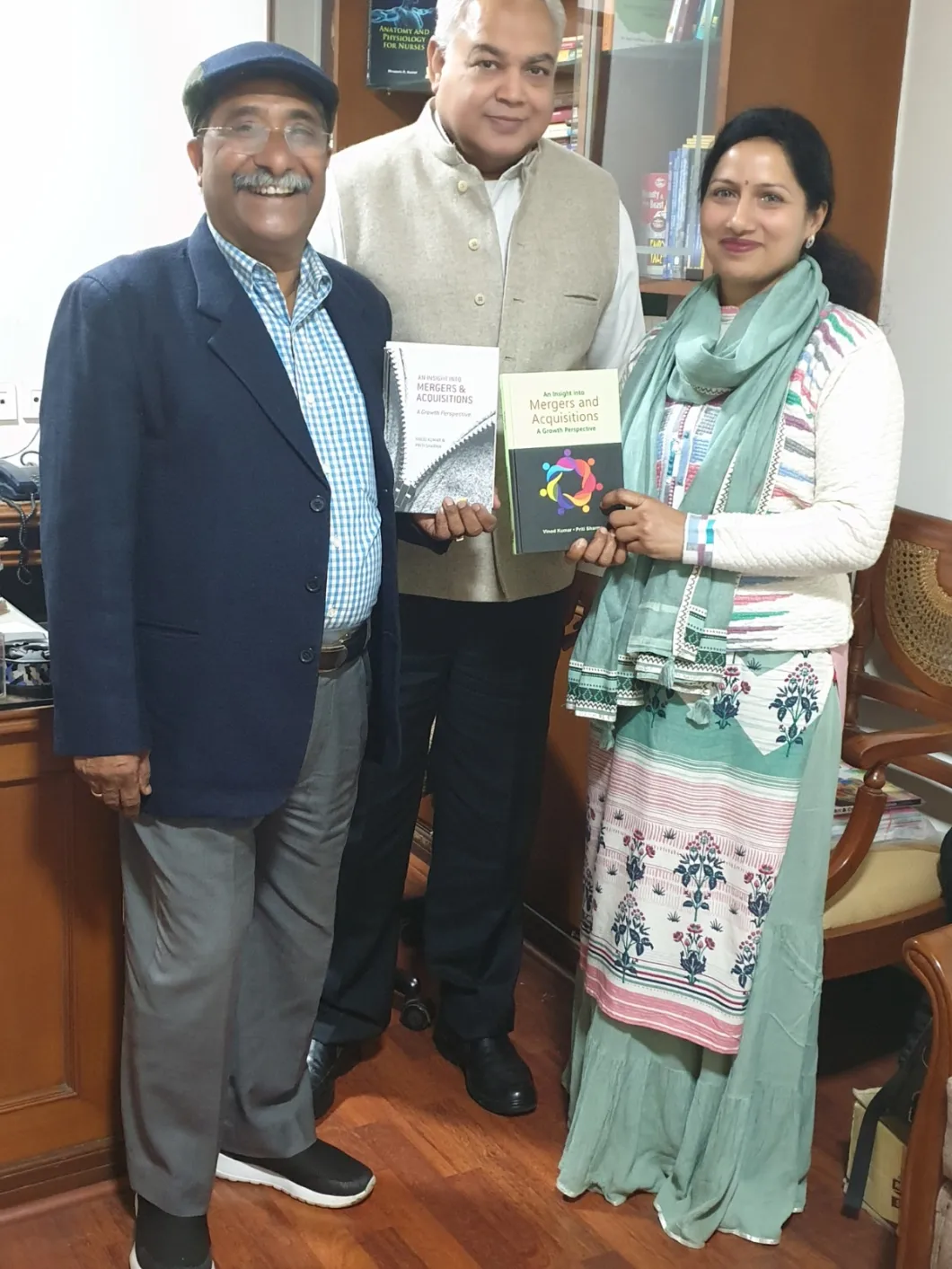

Author of the book ‘An Insight into Mergers and Acquisitions’ An International Publication with Palgrave Macmillan

She has more than two decades of academic and corporate experience. She is associated with the International College of Financial Planning(ICoFP) – A Bajaj Capital Group institute, ICFAI, National Stock Exchange and Bombay Stock Exchange as academic faculty. Dr. Sharma has worked with Flex Industries Ltd in the corporate finance division.

Her Academic & Research interests are Investments & Valuation, Financial Statement Analysis, Fintech, Blockchain, Mergers & Acquisitions and Mutual Funds.

Let’s Get Inspired

In Conversation with Dr. Priti Sharma

– Preeti Juneja

Q. How can we empower women with financial Literacy in a way that is easy to comprehend and applicable to their everyday experiences?

Financial Literacy is at the core of a self-reliant, confident and psychologically & financially secure society. One umbrella approach will not suffice when discussing women’s empowerment through financial Literacy.

Women who have access to education and are part of the active workforce to be sensitized and educated about the importance of financial planning, setting their life goals in time and building a systematic approach to secure their golden age while attaining all other important financial goals.

We must capitalize on digital infrastructure to leverage its reach and efficiency and conduct awareness sessions to take small steps through inculcating the habits of financial discipline, prudence and systematic investments. This could be supplemented with audio-visual resources to guide products and processes.

A different approach is required for women from marginalized communities and less privileged in terms of education and financial security. Volunteers, NGOs, and self-help groups must be built to work at the grassroots level and educate on the importance of earning and regularly saving small sums of money. These women to be provided with enablers like organized credit support, physical, financial & digital infrastructure and mentorship to start their own ‘Kuteer Udyog’ (cottage industry) or earn a livelihood for themselves and their families so that they do not become a victim of the unorganized debt trap. Self-help groups are to be encouraged for financial assistance and cooperative progress among women.

Creating financial awareness and handholding by volunteering educators, social workers and NGOs at their doorstep is a must to make a difference. Corporates, as part of their CSR activity and Government role, provide enablers in this direction.

Q. In the face of increasing competition, India’s M&A market remains robust, with buyers adopting advanced pre-deal scrutiny and thorough post-deal strategizing. Your authored work, “An Insight into Mergers and Acquisitions,” imparts valuable insights into the realm of M&A. What pivotal message from the book would you like to underscore in the current scenario?

Mergers & Acquisitions (M&A) are a way of faster growth and entry into a new market and product segment. M&As are quite frequent when a tech entrepreneur wants to develop a new technology or work towards advancing existing technology but needs more funds for its scalability and commercial application. A large entity often finds it useful to acquire such tech start-ups. A strategically planned and carefully executed M&A can be a boon for not only merging entities but also leading to consolidation in the industry and efficient utilization of resources.

M&A should never be governed by greed or poor reasons for making money or getting into the game of empire-building. It may lead to winning the deal but poses the risk of highly leveraged acquisition or overpaying for the target and being the victim of the winner’s curse. The acquirer should pursue only profitable growth opportunities, and strategic fit should be at the soul of M&A. The strict due diligence of operations, financial, legal, and human resources will ensure that M & A is not a nightmare. Merging entities should carefully craft the post-merger integration, clarity of roles, balance of power and plans to address the cultural differences.

Q. Do you have specific financial guidance for women breaking through the glass ceiling in the eCommerce industry? How can they upskill in business finance?

Every business segment has its dynamics. It is very important to understand the suppliers’ and buyers’ negotiating power for the industry, the nature of competition, trade requirements, and the availability of finance.

E-business requires the understanding of creating a user-friendly yet secure platform, which is to be backed by standard procedures and policies. Inventory Management and Logistics play a very significant role in the success of an e-commerce platform. Women should acquire these skill sets and trade requirements. Develop a team which has expertise in these critical areas.

Understanding of the various sources of short-term funding, receivable financing, and a flexible line of credit can help them to use funds as and when required and pay the finance charge on the actual amount and time of funds utilization. Equally important is managing long-term funds and carefully selecting the product lines they foray. Attending live training, being a part of industry forums, acquiring relevant certifications, and leveraging the power of the network are some of the key actions to make a strong footprint in the industry.

Q. Given your combined academic and corporate background, your well-rounded expertise positions you as an excellent career advisor, especially in finance. Is this an avenue you are considering exploring further in the future?

As educators, we have a moral responsibility to contribute and actively engage in guiding the new-age aspirants. We can make a difference in people’s lives by helping them in multiple ways. Today’s youth has a problem of choice and risk of being influenced by external stimuli like the attractiveness of a career option.

The correct approach is to map your strengths and capabilities with the chosen profession and build a roadmap to achieve your goals. Choosing the right career option is the foundation of a successful career and a satisfied life.

The pathways to achieving your desired goals are the acquisition of suitable skills, a well-designed approach, consistency of efforts, and hard work.

Continuous learning, staying motivated, maintaining physical and emotional fitness, and maintaining a work-life balance are the keys to a sustainable career and a good life. I am a person who can play a significant role in the lives of people by helping them make the right career choices and mentoring them to face challenges, handle stress, and achieve their desired goals.

Another aspect of people’s lives is a secure financial future, and the only way is financial discipline, starting regular investments at an early age, and building a balanced portfolio to meet their financial goals. As financial professionals, our role is to sensitize people about this significant aspect and help them make the right financial decisions.

As a management educator, I see the importance of guiding working professionals to lead a balanced life, upskill themselves, handle stress, manage time, be a contributor and, at the same time, enjoy this journey called ‘life’.

Q. For women who are reluctant to take risks, would delving into finance be an effective means to dispel such apprehensions?

Yes, taking risks is correlated with the ability to take risks and an attitude towards risk-taking. The knowledge of finance is necessary for everyone, specifically women because it gives them the confidence to make the right financial decisions. You can build a financial cushion that enhances your ability to take risks.

our investments should serve as a second income stream, and your money should work for you rather than you working for money.

The risk-taking attitude manifests as having a strong financial cushion, a secondary income stream and a strong support system on which you can fall back in tough times.

Rapid-Fire:

- Highlight a prominent trend in the field of finance: Digital Revolution in the form of UPI payments, crossing more than 100 billion transaction processed through UPI in December 2023.

- The Interim Budget 2024 is focused on youth and women empowerment. What are your views? Yes, the focus of interim budget is to make economy more inclusive with a focus on Poor, Youth, Women and Farmers. The budget focuses on Skill India Mission and provide opportunities for skill development and entrepreneurship. Entrepreneurial assistance in the form of loans under PM Mudra Yojna is another enabler.

On the similar lines for women, loans are given under Mudra Yojna. The focus is on education and financial empowerment. The target is to increase the women gross enrolment in higher education and leverage on the strength of Self Help Group mechanism to financially empower the women.

- How do you stay motivated? Setting goals, taking small steps on a consistent basis, measuring progress, and rewarding myself on each milestone achieved. My focus is on focused ‘Karma’ and outcome as a byproduct. Also building positive habits, maintaining a healthy lifestyles and physical fitness helps a lot to stay motivated.

- One life suggestion that you would like to give youngsters? Keep your aspirations alive and yet develop resilience to accept the life as it unfolds through developing positive habits.

One-Liners:

- Education opens the door to: New Horizons and Rational Thinking

- The light in my life is: My Family, a meaningful profession to help me to contribute significantly and bring a sense of satisfaction.

- Fintech education helps to: More inclusivity and affordability.

- My hobbies are: Reading, listening to great people and going out in the sunshine.

About Author

Dr. Priti Sharma

Dr Priti Sharma has a doctorate in finance from Aligarh Muslim University. She has developed the e-content for the ePG Pathshala Project of MHRD for the Financial Institutions & Markets Course of the Masters of Business Economics Program.

At the Institute of Management Technology, Centre of Distance Learning (IMTCDL), Dr Priti Sharma is an Associate Professor and Area Chair of finance. Her other roles include Chairperson of the Information Management Committee, Member of the Academic Advisory Council, Member of the Board of Governors, Faculty in-charge of Alumni Relations, and Head of Administration.

7th February 2024

Share this article

Inspiring Women

- #FEAR, #FEMALEEMPOWERMENT, #GIRLBOSS, #INSPIRINGWOMAN, #WOMENMAKINGHISTORY, BLOCKCHAIN, CAREERCOUNSELL, EmpoweringWomen, FINANCEEDUCATION, FINANCELITERACY, FINTECH, IMTCDL, InspirationalLadies, inspiringwomen, MANAGEMENTSTUDIES, PROFESSOR, SheInspires, StrongWomen, TrailblazingWomen, womenachievers, WomenInPower, WomenOfImpact, WomenWhoLead

Share this article

Do you have a question for Dr. Priti Sharma ? Write to us at preeti.juneja@dreamwebindia.com