There is a plethora of choices for the Indian consumer in health drinks. Classification of health beverages based on age criterion or functional requirements will let one decide when buying a health drink. Be it weight management, lactating mothers, growing children, or athletic performance, there are specialized drinks for each category and a generic version covering a broad spectrum. When a regular diet does not suffice the nutritional deficits of the modern day, a health beverage fortified with proteins, vitamins, and minerals is a panacea.

Market Valuation & Size of the Health Beverages Industry in India

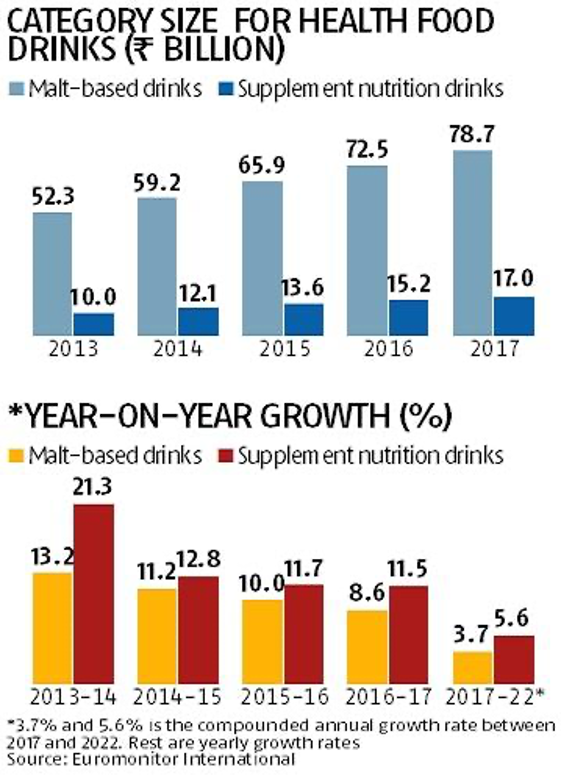

India’s Health Beverages industry is valued at INR 43000 Crores and is growing at 15% to 18% every year by value and is proposed to reach INR 130,000 Crores by the year 2023. Health drinks and protein shakes are a popular subset of the Health and Beverages Industry, including packaged fresh fruit and vegetable juices, probiotics, food powder, energy drinks, and others. The projected growth rate of the Indian Health beverages Industry is 9.89% over five years between 2022 till 2026 and is estimated to reach 3.84 billion USD by 2026.

The (RDA) Recommended Dietary Allowance given by the Indian Council of Medical Research for Indians requires 0.8 gm to 1 gm of protein per Kg of body weight per day for an average person. According to the Indian Market Research Bureau survey conducted in 2017, 73% of the high-income Urban population in India is protein deficient, and 93% are unaware of their daily protein requirement. However, in the Post Covid scenario, there is an increasing awareness of including a healthy diet to maintain a healthy lifestyle. 70% of the Indian Population is committed to this cause. The lifestyle shift of young consumers, especially the urban youth between the age of 20 years to 35 years, towards healthier options is significantly contributing to the success of the health drinks market. The target consumers are mainly prevalent in metros and cities; however, the health drink trend is also catching on to other demographics. The health drinks business has its significant current contribution of 40% from large metros like Delhi and Mumbai. The secret to its growth stays in the hands of the increasing purchasing power of the Millennials in India and their constant lookout for specific criteria in health food in the market, like functional ingredients or plant-based alternatives.

Major Players in the Health Food Drink segment

- Danone with the Protinex brand

- Unilever with Horlicks and Boost

- Abbot with Ensure and Pediasure

- Mondelez with Bournvita

An analysis of the list above will clearly show that it contains a mix of traditional brands of health drinks and their more recent competitors. How has Danone been able to take a pie of the Indian market share despite the strong advertising campaigns of Horlicks and Boost? The answer to this inevitable question stays with a change in customer buying behavior.

Complan, Horlicks, and Boost have been market leaders with a strong sales history and have been intertwined with Indian households for several decades. The market leaders are rapidly losing market share to premium international brands of supplement nutrition drinks and affordable Indian brands. Horlicks, Boost, and Bournvita are malted Health drinks containing malt. Malt is a germinated cereal grain that goes through a malting process resulting in a Health Food Drink that contains proteins, minerals, and sugar. Since the Indian middle class has become very conscious of nutritional labels and sugar intake, a trend of a consumer shift towards low-sugar variants with higher nutrients has been seen. Protinex by Danone has 8 gms of protein per serving, whereas Complan has 5.9 gms of protein.

Similarly, Abbot a well-known premium brand, was able to capture market share through D2C targeting. The Direct-to-Consumer approach and medical reputation brand building helped Abbot gain rapid market share, thus increasing the sales of Ensure and Pediasure. Nutritional health drinks garnered more sales with the popularity of large store formats and e-commerce.

The presence of ayurvedic herbs like Brahmi and plant-based ingredients made local affordable health drinks like Patanjali’s Powervita and the Badam drink by MTR preferred over malt beverages as they were comparatively very affordable to the Indian consumers.

Read the nutritional label before you make the prudent choice.

Protein shakes in the Indian market do not contain steroids; for instance, whey protein, the most commonly found ingredient of a protein shake, is a safe milk product, and they do not contain anabolic steroids that are detrimental to human health. Artificial sweeteners like acesulfame potassium and sucralose will sate the quest for a sweet taste with zero calories. Still, in the long run, they will cause a loss in performance and various side effects. Prefer health drinks that contain low-calorie natural sweeteners such as stevia or certain fruit extracts. Numerous protein shakes in the market can be beneficial for maintaining proper protein uptake and preventing muscle loss in athletes and regular Gym goers. Protein shakes and protein powders from Apollo, Oziva, Muscle Blaze, Himalaya, Marico’s Fittify, Optimum Nutrition, Inlife, and others compete for market share in this competitive space.

Beverages fortified with protein are a must-have for the Indian population.

Beverages fortified with protein are essential in sports nutrition and treating convalescing patients, senior citizens, and the malnourished. Most women and children in India fall under the malnourished category. FSSAI has given permissible limits for fortification for each food product, and the consumption of protein-fortified health drinks is safe if within the permissible range as prescribed by the Food Safety and Standards Authority of India. For processed health drinks, certain ingredients lose their natural elements; hence, fortification will help regain the proteins and vitamins lost during processing. The bitter taste of fortification can be neutralized with enzymatic modification. Ready to drink fortified protein shakes in single-use packaging are recently gaining popularity in Gyms and health clubs. Probiotics are a flourishing market that aims to improve general gut health.

With more Research and Development in the fortified health drinks segment, more players are likely to compete with specialized solutions for health woes with uniquely fortified variants like vegan fortified health drinks. This trend towards the consumer’s quest for healthier options in the health beverages industry is here to stay for the long term. If traditional malt-based drinks are to withhold their market share, then quick innovation from their side is the need of the hour.

7th February 2023

Share this article

promoting-better-nutrition-how-the-health-drinks-industry-in-india-has-proliferated

Important Links

Share this article

Do you have a question for? Write to us at contact.dwindia@gmail.com